TORONTO – United states stock markets turned lower Friday carrying out a few days of solid advances amid declining oil prices and renewed concerns inside the U.S. economic recovery.

The Toronto Stock Exchange’s S&P/TSX composite index unofficially closed down just 10.51 points, or 0.08 percent, at 12,763.99, after paring earlier losses.

In Ny, the Dow Jones industrial average was down 211.75 points, or 1.29 percent, to 16,204.83, the S&P 500 had lost 35.43 points, or 1.85 percent, to at least one,880.02 and the Nasdaq Composite had dropped 146.42 points, or 3.25 %, to 4,363.14.

In commodities, the March deal for United states benchmark oil slipped for just about any second straight day, down 83 cents to US$30.89 a barrel.

The March deal for gas rose nine cents to US$2.06 per mmBtu, while April gold added 20 cents to US$1,157.70 a troy ounce and March copper shed three cents to US$2.10 one pound.

Meanwhile, the oil-sensitive Canadian dollar also retreated, down 0.85 of the U.S. cent at 71.90 cents US.

In economic news, Statistics Canada reported the unemployment rate rose to 7.2 percent in January. Economists had expected that it is stable at 7.1 %.

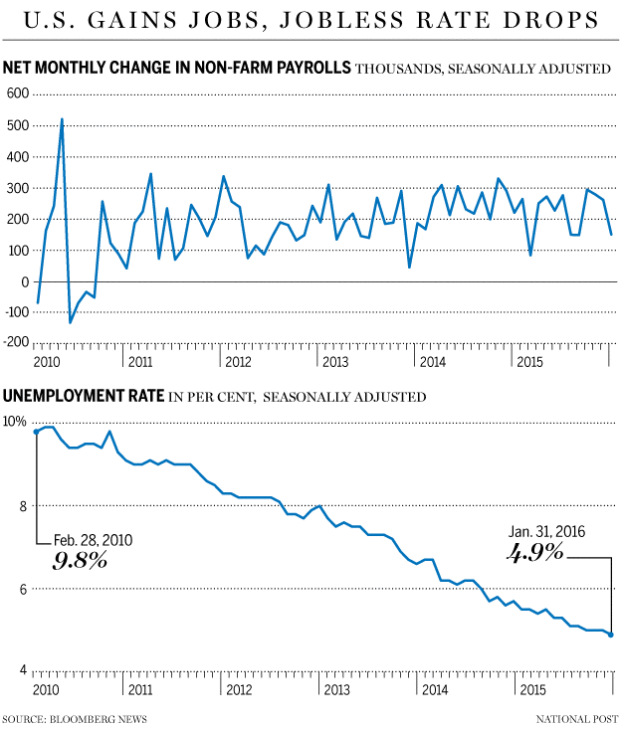

South from the border, the Labor Department reported that U.S. employers added just 151,000 jobs in January, a clear, crisp deceleration from recent months as companies shed education, transportation and temporary workers. That was below economists’ forecasts in the development of 185,000 jobs, based on data from Factset.

On the positive side, the unemployment rate fell to 4.9 % from Five percent, the minimum level since February 2008 and average wages were up 2.5 percent within the last year to $25.39 an hour.

“It’s a rather difficult report to interpret,” Russ Koesterich, global market strategist with asset manager BlackRock, said in the employment numbers which came after reports this year’s week pointed with a slowdown in manufacturing in the usa and China.

“It confirms there’s been some deceleration within the U.S. economy. Nobody is falling the cliff, nevertheless it reveals the U.S. economy isn’t protected from the worldwide slowdown,” Koesterich told The Associated Press.

On another hand, the data showing hourly wages are increasing is an early manifestation of inflation within the outlook during the federal government Reserve, that might result in the U.S. central bank to help keep raising rates within a slowing economy, Koesterich said.

“You potentially have of sentimental growth and monetary tightening, and that is not really a great way being becoming an investor,” he was quoted saying.