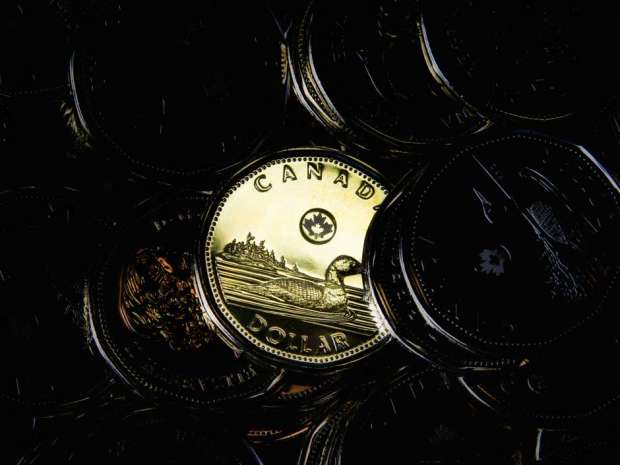

The loonie’s worst collapse against the U.S. dollar in the history may be within the rearview mirror as a most of economists now see the currency staying at current levels or higher by the end of the year.

'This market is a volatile business': Is the recent TSX rally the calm prior to the storm?

Investors in Canadian equities have spent the very first seven weeks of the season on the jolting roller-coaster ride

Read more

Canada’s dollar has been one of the world’s worst performing currencies, like a crash in oil prices and rate of interest cuts by the Bank of Canada caused it to lose 16 per cent of its value against the greenback this past year alone – its biggest annual loss ever.

The past 3 years have experienced the loonie fall faster against its counterpart than at any other reason for its 45-year history like a free-floating currency, a collapse that brought it from parity using the U.S. dollar to below 69 cents recently.

“With Canadian monetary policy going for a backseat to fiscal stimulus, Fed rate hikes being delayed until later around and oil prices appearing to have bottomed out we’ve strengthened our near-term forecast for the Canadian dollar,” said economists at CIBC World Markets in their latest foreign exchange outlook released Tuesday. “Indeed, it’s now likely the loonie has witnessed the worst from the depreciation, even if it has one slight dip ahead.”

One Canadian dollar currently buys 72.6 U.S. cents, based on Tuesday’s exchange rate. That is a slight improvement in the 13-year low of 68.64 cents seen recently when the American dollar hit its highest level from the loonie in 13 years. That spike occurred on the back of the further capitulation in oil prices, which raised expectations the Bank of Canada would have to loosen monetary policy further.